AI tutor

Welcome to Bytelearn!

Let’s check out your problem:

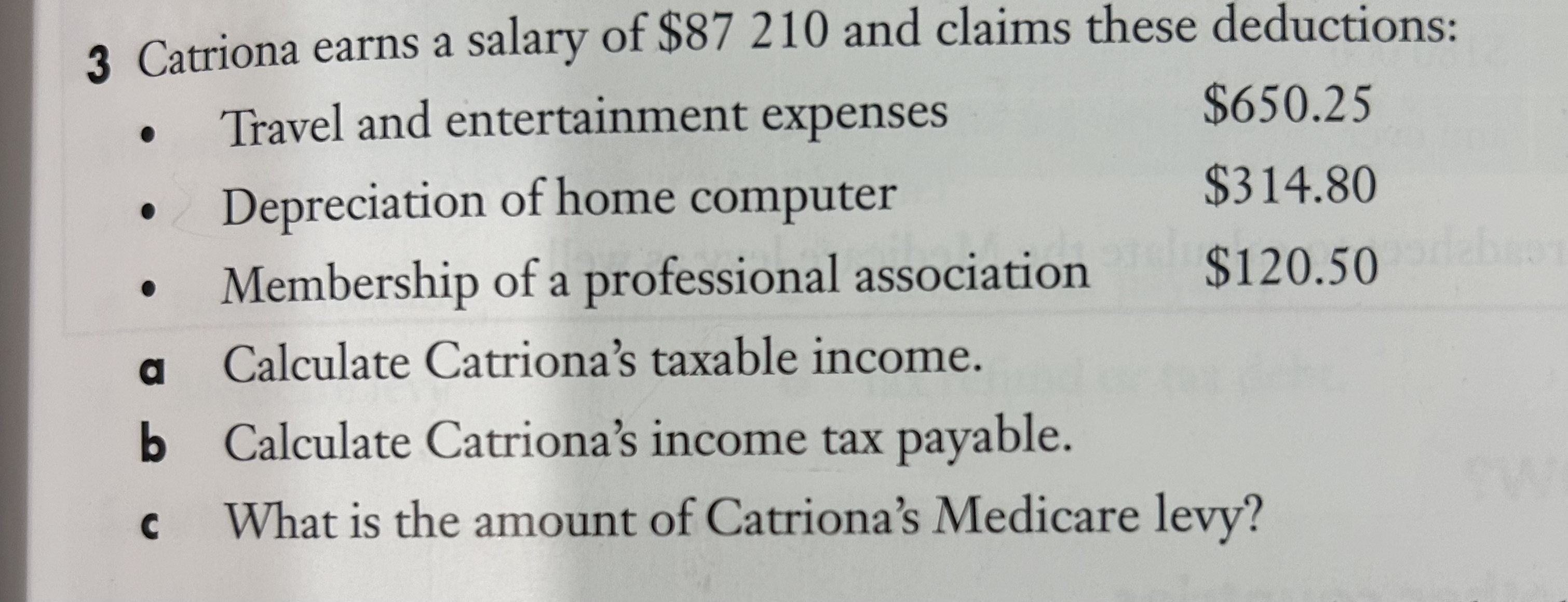

Catriona earns a salary of and claims these deductions:Travel and entertainment expenses Depreciation of home computer Membership of a professional association a Calculate Catriona's taxable income.b Calculate Catriona's income tax payable.c What is the amount of Catriona's Medicare levy?

Full solution

Q. Catriona earns a salary of and claims these deductions:Travel and entertainment expenses Depreciation of home computer Membership of a professional association a Calculate Catriona's taxable income.b Calculate Catriona's income tax payable.c What is the amount of Catriona's Medicare levy?

- Calculate Total Deductions: Calculate Catriona's total deductions by adding travel and entertainment expenses, depreciation of home computer, and membership of a professional association.

- Subtract from Salary: Subtract the total deductions from Catriona's salary to find her taxable income.

- Calculate Income Tax: To calculate Catriona's income tax payable, we need to know the tax rates applicable to her taxable income. Since the problem does not provide a tax rate or bracket information, we cannot calculate the income tax payable without additional information.

- Calculate Medicare Levy: To calculate Catriona's Medicare levy, we need to know the percentage rate of the levy. Since the problem does not provide the Medicare levy rate, we cannot calculate the Medicare levy without additional information.

More problems from Solve system of equations: Complex word problems

QuestionGet tutor help

QuestionGet tutor help