AI tutor

Welcome to Bytelearn!

Let’s check out your problem:

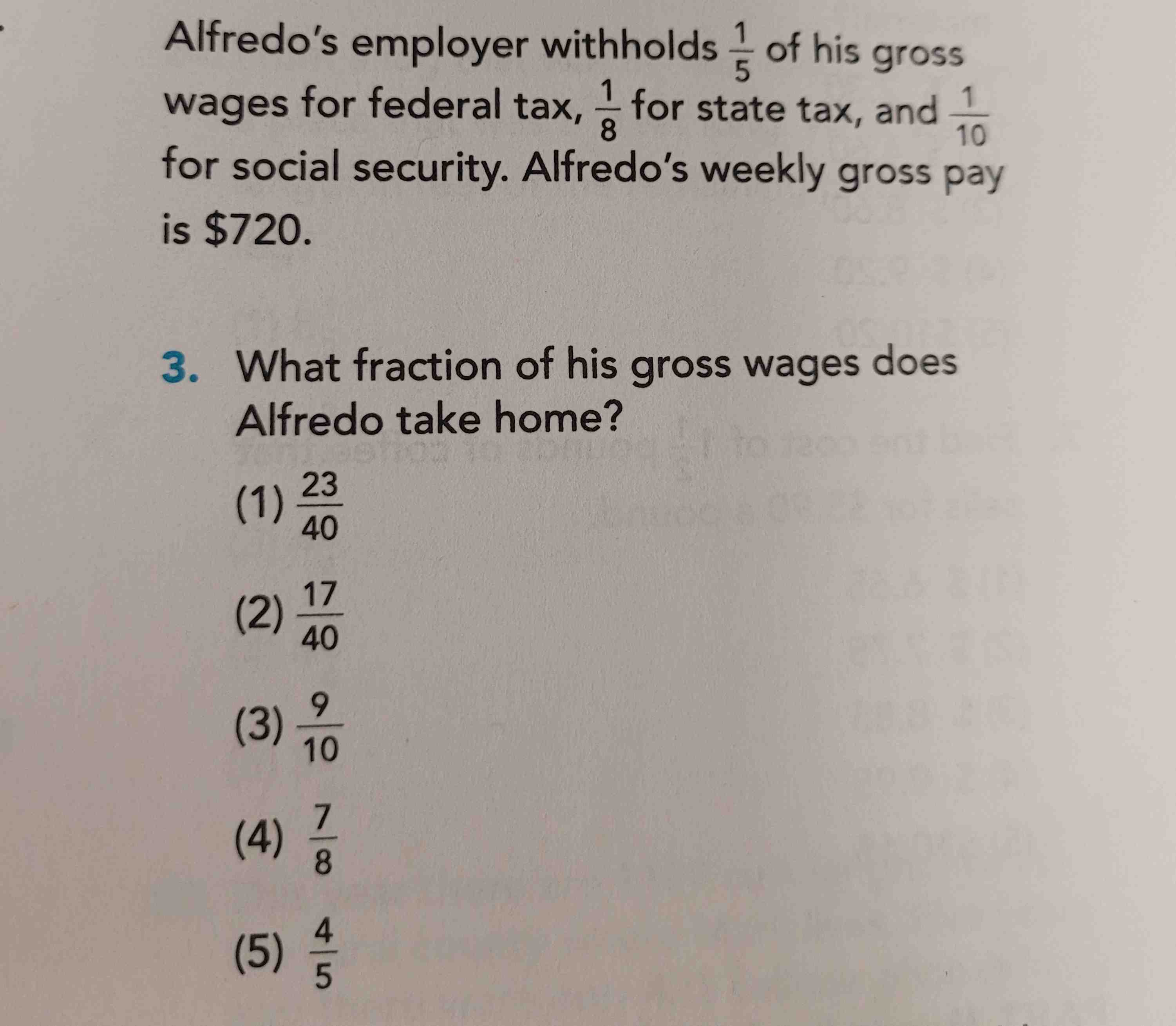

Alfredo's employer withholds of his gross wages for federal tax, for state tax, and for social security. Alfredo's weekly gross pay is . What fraction of his gross wages does Alfredo take home? () () () () ()

Full solution

Q. Alfredo's employer withholds of his gross wages for federal tax, for state tax, and for social security. Alfredo's weekly gross pay is . What fraction of his gross wages does Alfredo take home? () () () () ()

- Calculate Total Fractions: Calculate the total fraction of Alfredo's wages withheld for taxes and social security. Federal tax withheld = , State tax withheld = , Social security withheld = . Add these fractions: . To add, find a common denominator, which is . .

- Determine Take-Home Fraction: Determine the fraction of wages Alfredo takes home. Since of his wages are withheld, he takes home of his wages.

More problems from Operations with rational exponents

QuestionGet tutor help

QuestionGet tutor help