Full solution

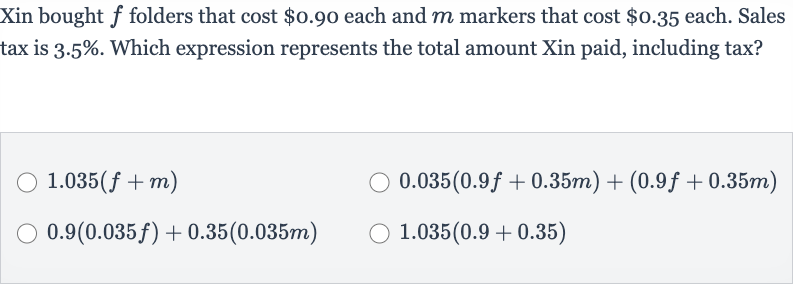

Q. Xin bought folders that cost each and markers that cost each. Sales tax is . Which expression represents the total amount Xin paid, including tax?

- Calculate Total Cost: First, we need to calculate the total cost of the folders and markers before tax. We do this by multiplying the number of folders by the cost per folder, and the number of markers by the cost per marker.Total cost before tax =

- Calculate Sales Tax: Next, we need to calculate the sales tax on the total cost before tax. The sales tax rate is , which we can express as a decimal by dividing by . So, becomes .Sales tax

- Add Sales Tax: Now, we add the sales tax to the total cost before tax to get the total amount paid.Total amount paid Total cost before tax Sales tax

- Combine Steps: We can combine the previous steps into a single expression that represents the total amount paid, including tax. Since the sales tax applies to the entire cost before tax, we can factor out the tax rate as a multiplier of the sum of the cost of folders and markers.Total amount paid =

- Simplify Expression: Simplify the expression by combining the and to get the total multiplier for the tax.Total amount paid = This is the correct expression that represents the total amount Xin paid, including tax.

More problems from Evaluate two-variable equations: word problems

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help