Full solution

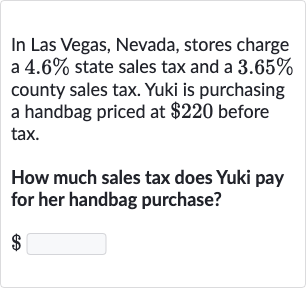

Q. In Las Vegas, Nevada, stores charge a state sales tax and a county sales tax. Yuki is purchasing a handbag priced at before tax. How much sales tax does Yuki pay for her handbag purchase?

- Calculate Total Sales Tax Rate: First, we need to calculate the total sales tax rate by adding the state sales tax rate and the county sales tax rate.State sales tax rate: County sales tax rate: Total sales tax rate =

- Convert Percentage to Decimal: Now, let's convert the percentage to a decimal to make the calculation easier.Total sales tax rate = To convert this to a decimal, we divide by .

- Calculate Sales Tax Amount: Next, we calculate the amount of sales tax Yuki will pay for her handbag purchase.Handbag price before tax: Total sales tax rate (as a decimal): Sales tax amount = Handbag price before tax Total sales tax rateSales tax amount =

- Perform Multiplication: Now, we perform the multiplication to find the sales tax amount. Sales tax amount =

More problems from Multi-step problems with percents

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help