AI tutor

Welcome to Bytelearn!

Let’s check out your problem:

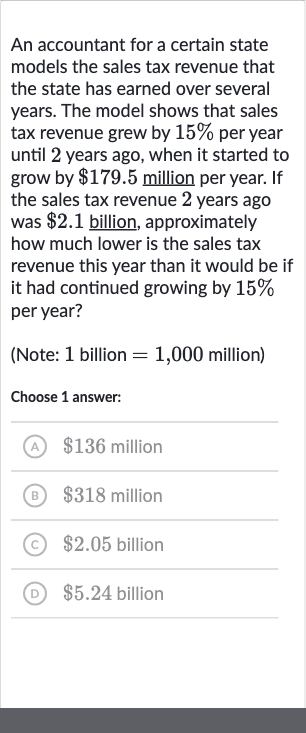

An accountant for a certain state models the sales tax revenue that the state has earned over several years. The model shows that sales tax revenue grew by per year until years ago, when it started to grow by million per year. If the sales tax revenue years ago was billion, approximately how much lower is the sales tax revenue this year than it would be if it had continued growing by per year? (Note: billion million) Choose answer: (A) million (B) million (C) billion (D) billion

Full solution

Q. An accountant for a certain state models the sales tax revenue that the state has earned over several years. The model shows that sales tax revenue grew by per year until years ago, when it started to grow by million per year. If the sales tax revenue years ago was billion, approximately how much lower is the sales tax revenue this year than it would be if it had continued growing by per year? (Note: billion million) Choose answer: (A) million (B) million (C) billion (D) billion

- Calculate Sales Tax Revenue: Calculate the sales tax revenue if it had continued growing by % per year for two years.Sales tax revenue years ago = billionGrowth rate = per yearSales tax revenue if growth continued for year = billion billion

- Continue First Year's Growth: Continue the calculation for the first year's growth. Sales tax revenue if % growth continued for year = billion billion

- Calculate Second Year's Growth: Calculate the sales tax revenue if the \% growth continued for the second year.Sales tax revenue if \% growth continued for years = billion billion

- Continue Second Year's Growth: Continue the calculation for the second year's growth. Sales tax revenue if % growth continued for years = billion billion

- Calculate Actual Revenue: Calculate the actual sales tax revenue for this year.Actual sales tax revenue years ago = billionGrowth per year for the past years = millionActual sales tax revenue for this year = billion + * million

- Continue Actual Revenue Calculation: Continue the calculation for the actual sales tax revenue.Actual sales tax revenue for this year = billion + * million = billion + million = billion

- Calculate Revenue Difference: Calculate the difference between the projected sales tax revenue (if it had grown by % per year) and the actual sales tax revenue.Difference = Projected sales tax revenue - Actual sales tax revenueDifference = billion - billion

- Continue Difference Calculation: Continue the calculation for the difference.Difference = billion - billion million

More problems from Scale drawings: word problems

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help