AI tutor

Welcome to Bytelearn!

Let’s check out your problem:

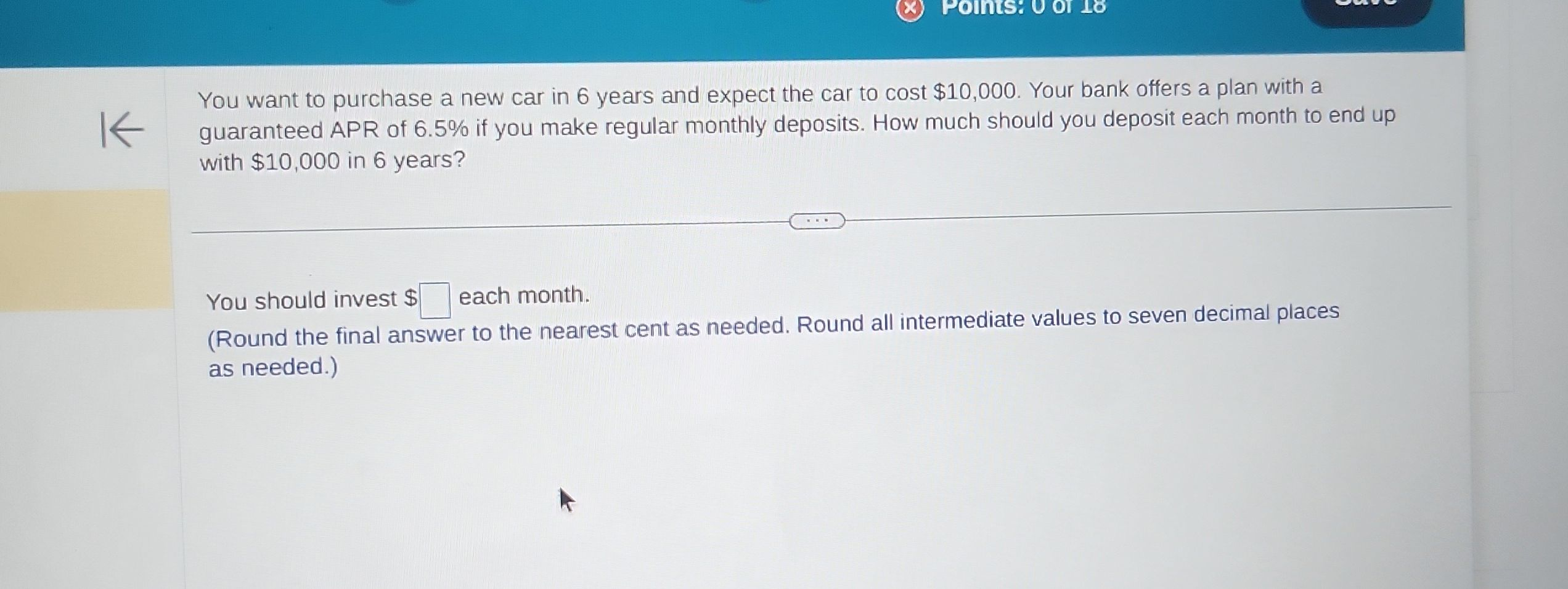

You want to purchase a new car in years and expect the car to cost . Your bank offers a plan with a guaranteed APR of if you make regular monthly deposits. How much should you deposit each month to end up with in years?You should invest each month.(Round the final answer to the nearest cent as needed. Round all intermediate values to seven decimal places as needed.)

Full solution

Q. You want to purchase a new car in years and expect the car to cost . Your bank offers a plan with a guaranteed APR of if you make regular monthly deposits. How much should you deposit each month to end up with in years?You should invest each month.(Round the final answer to the nearest cent as needed. Round all intermediate values to seven decimal places as needed.)

- Identify Formula: Identify the formula to calculate the monthly deposit needed to reach a future value with regular deposits at a given interest rate.The formula for the future value of a series of equal monthly deposits (ordinary annuity) is:Where: = future value = monthly deposit = monthly interest rate = number of times the interest is compounded per year = number of yearsWe need to solve for .

- Convert APR to Monthly Rate: Convert the annual percentage rate (APR) to a monthly interest rate.APR = or as a decimal.Monthly interest rate () = (rounded to seven decimal places)

- Determine Compounding Frequency: Determine the number of times the interest is compounded per year and the total number of years . Since the deposits are monthly, the interest is compounded monthly, so . The time period is years, so .

- Substitute Values and Solve: Substitute the values into the formula and solve for .Substitute these values into the formula:

- Calculate Value Inside Brackets: Calculate the value inside the brackets.= = (rounded to seven decimal places)

- Divide Future Value to Find P: Divide the future value by the result inside the brackets to find P. (rounded to the nearest cent)

More problems from Exponential growth and decay: word problems

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help