Full solution

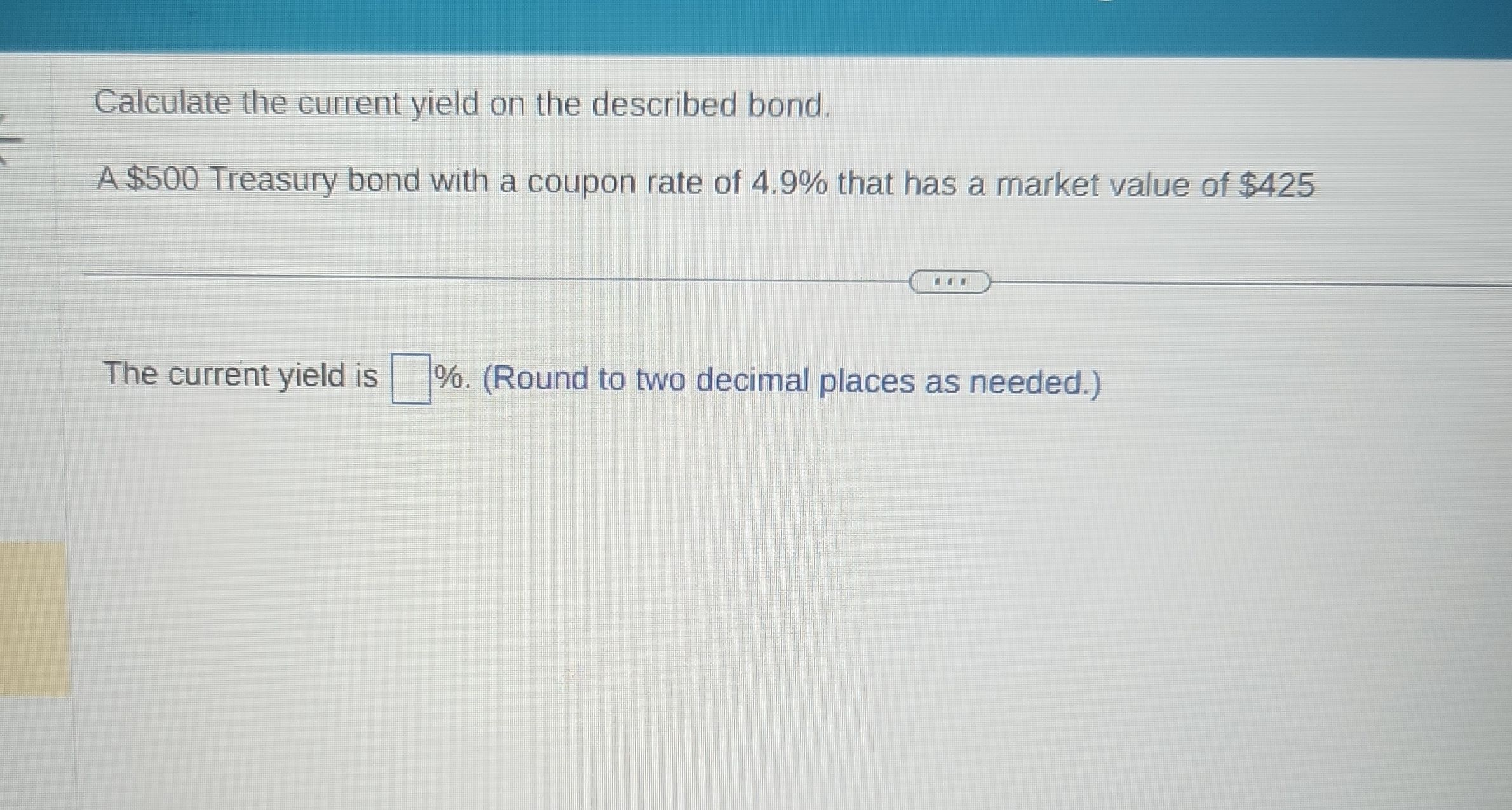

Q. Calculate the current yield on the described bond.A Treasury bond with a coupon rate of that has a market value of The current yield is . (Round to two decimal places as needed.)

- Understand current yield: Understand what current yield means.The current yield of a bond is calculated by taking the bond's annual interest payment and dividing it by its current market price. Specifically, the formula is .

- Calculate interest payment: Calculate the annual interest payment.The bond has a coupon rate of , which means it pays of its face value in interest each year.Annual interest payment = (Coupon rate) (Face value)= =

- Calculate current yield: Calculate the current yield.Current yield = (Annual interest payment) / (Market value)=

- Perform division: Perform the division to find the current yield.Current yield = =

- Convert to percentage: Convert the current yield to a percentage and round to two decimal places.Current yield in percentage = = Rounded to two decimal places:

More problems from Exponential growth and decay: word problems

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help