AI tutor

Welcome to Bytelearn!

Let’s check out your problem:

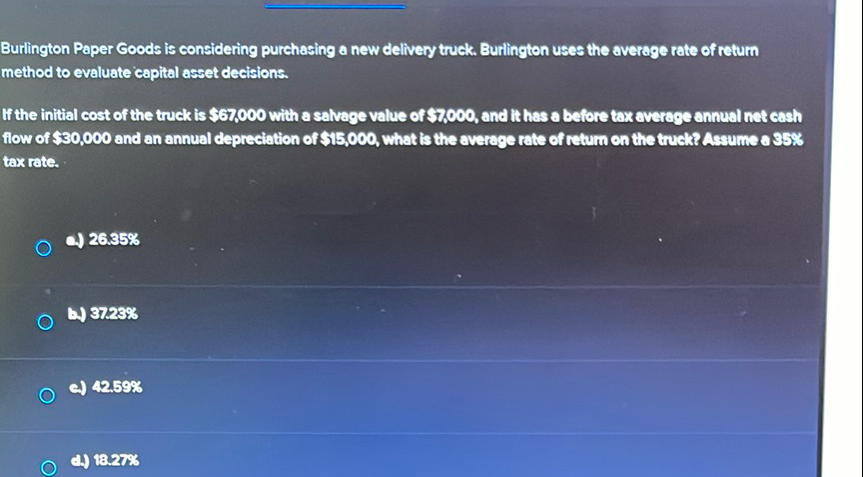

Burlington Paper Goods is considering purchasing a new delivery truck. Burlington uses the average rate of return method to evaluate capital asset decisions.If the initial cost of the truck is with a salvage value of , and it has a before tax average annual net cash fiow of and an annual depreciation of , what is the average rate of retum on the truck Assume a tax rate.a) b) c) d)

Full solution

Q. Burlington Paper Goods is considering purchasing a new delivery truck. Burlington uses the average rate of return method to evaluate capital asset decisions.If the initial cost of the truck is with a salvage value of , and it has a before tax average annual net cash fiow of and an annual depreciation of , what is the average rate of retum on the truck Assume a tax rate.a) b) c) d)

- Calculate Average Investment: Calculate the average investment.The average investment is the sum of the initial cost and the salvage value, divided by .Average Investment = Average Investment = Average Investment = Average Investment =

- Calculate Annual Net Cash Flow: Calculate the annual net cash flow after taxes.To find the after-tax cash flow, we subtract the tax impact of the depreciation from the before-tax cash flow.Tax savings from depreciation = Depreciation Tax RateTax savings from depreciation = Tax savings from depreciation = After-tax cash flow = Before-tax cash flow - Tax savings from depreciationAfter-tax cash flow = After-tax cash flow =

- Calculate Average Rate of Return: Calculate the average rate of return.The average rate of return is the after-tax cash flow divided by the average investment.Average Rate of Return = Average Rate of Return = \times \%\)Average Rate of Return = Average Rate of Return = .\%

More problems from Volume of cubes and rectangular prisms: word problems

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help