AI tutor

Welcome to Bytelearn!

Let’s check out your problem:

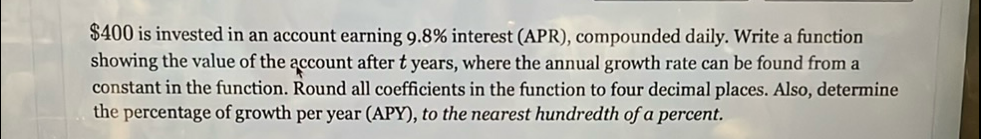

is invested in an account earning .\% interest (APR), compounded daily. Write a function showing the value of the account after years, where the annual growth rate can be found from a constant in the function. Round all coefficients in the function to four decimal places. Also, determine the percentage of growth per year (APY), to the nearest hundredth of a percent.

Full solution

Q. is invested in an account earning .\% interest (APR), compounded daily. Write a function showing the value of the account after years, where the annual growth rate can be found from a constant in the function. Round all coefficients in the function to four decimal places. Also, determine the percentage of growth per year (APY), to the nearest hundredth of a percent.

- Compound Interest Formula: To write the function for the account value after years with daily compounded interest, we need to use the formula for compound interest: , where is the amount of money accumulated after years, including interest, is the principal amount (the initial amount of money), is the annual interest rate (decimal), is the number of times that interest is compounded per year, and is the time the money is invested for in years.

- Convert Annual Interest Rate: First, we convert the annual interest rate from a percentage to a decimal by dividing by . The annual interest rate (APR) is , so in decimal form, it is .

- Determine Compounding Frequency: Since the interest is compounded daily, we need to determine the value of , which is the number of times the interest is compounded per year. There are days in a year, so .

- Write Account Value Function: Now we can write the function for the account value after years. Let's denote the function as , where represents the value of the account after years. Using the compound interest formula, we have:.

- Round Coefficients to Four Decimal Places: To round all coefficients in the function to four decimal places, we need to round the value inside the parentheses. The daily interest rate rounded to four decimal places is approximately .

- Calculate Annual Percentage Yield: The function with the rounded daily interest rate coefficient is: .

- Calculate APY with Values: To find the annual percentage yield (APY), we use the formula , where is the annual interest rate (decimal) and is the number of compounding periods per year. We then convert the result back to a percentage by multiplying by .

- Evaluate APY Expression: Using the values we have, the APY is calculated as follows:APY = .

- Convert APY to Percentage: Now we evaluate the expression to find the APY:APY = .

- Final APY Calculation: After calculating the above expression, we get the APY as a decimal. To convert it to a percentage, we multiply by . APY .

- Final APY Calculation: After calculating the above expression, we get the APY as a decimal. To convert it to a percentage, we multiply by . APY . Evaluating the expression gives us the APY as a percentage. Let's calculate it: APY (rounded to the nearest hundredth of a percent).

More problems from Use normal distributions to approximate binomial distributions

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help