Full solution

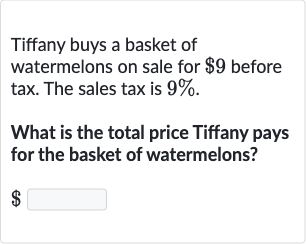

Q. Tiffany buys a basket of watermelons on sale for before tax. The sales tax is .What is the total price Tiffany pays for the basket of watermelons?

- Identify price and tax rate: Identify the original price of the basket of watermelons and the sales tax rate.Original price of the basket of watermelons: Sales tax rate:

- Calculate sales tax: Calculate the amount of sales tax Tiffany has to pay.Sales tax amount = Original price Sales tax rateSales tax amount =

- Perform calculation for tax amount: Perform the calculation to find the sales tax amount. Sales tax amount =

- Add tax to original price: Add the sales tax amount to the original price to find the total price.Total price = Original price + Sales tax amountTotal price = +

- Calculate total price: Perform the calculation to find the total price.Total price =

More problems from Multi-step problems with percents

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help