Full solution

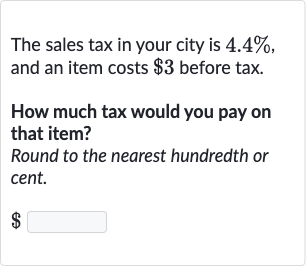

Q. The sales tax in your city is , and an item costs before tax. How much tax would you pay on that item? Round to the nearest hundredth or cent.

- Identify Cost and Tax Rate: Identify the original cost of the item and the sales tax rate.Original cost of the item: Sales tax rate:

- Calculate Sales Tax: Calculate the amount of sales tax by multiplying the original cost by the sales tax rate.Sales tax = Original cost Sales tax rateSales tax =

- Perform Multiplication: Perform the multiplication to find the sales tax.Sales tax =

- Round to Nearest Cent: Round the sales tax to the nearest hundredth or cent.Rounded sales tax =

More problems from Multi-step problems with percents

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help