AI tutor

Welcome to Bytelearn!

Let’s check out your problem:

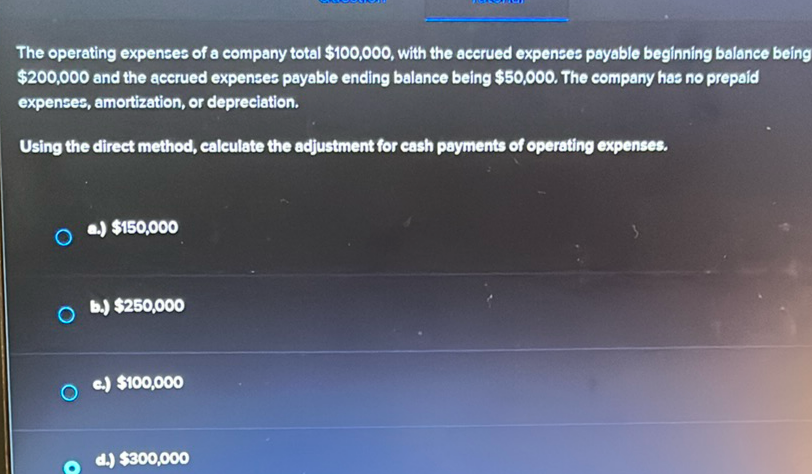

The operating expenses of a company total , with the acerued expenses payable beginning balance being and the accrued expenses payable ending balance being . The company has no prepaid expenses, amortization, or depreciation.Using the direct method, caleulate the adjustment for cash payments of operating expenses.a) b.) c) d)

Full solution

Q. The operating expenses of a company total , with the acerued expenses payable beginning balance being and the accrued expenses payable ending balance being . The company has no prepaid expenses, amortization, or depreciation.Using the direct method, caleulate the adjustment for cash payments of operating expenses.a) b.) c) d)

- Understand the problem: Understand the problem.We need to calculate the cash payments for operating expenses using the direct method. We have the total operating expenses, the beginning balance of accrued expenses payable, and the ending balance of accrued expenses payable. There are no prepaid expenses, amortization, or depreciation to consider.

- Calculate adjustment: Calculate the adjustment for cash payments of operating expenses. Using the direct method, we adjust the total operating expenses by the change in accrued expenses payable. The formula is:

- Insert values: Insert the given values into the formula.Cash payments for operating expenses =

- Perform calculation: Perform the calculation.Cash payments for operating expenses =

More problems from Debit cards and credit cards

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help