AI tutor

Welcome to Bytelearn!

Let’s check out your problem:

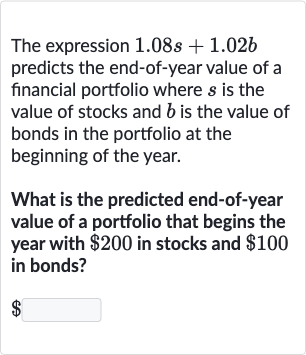

The expression predicts the end-of-year value of a financial portfolio where is the value of stocks and is the value of bonds in the portfolio at the beginning of the year.What is the predicted end-of-year value of a portfolio that begins the year with in stocks and in bonds?

Full solution

Q. The expression predicts the end-of-year value of a financial portfolio where is the value of stocks and is the value of bonds in the portfolio at the beginning of the year.What is the predicted end-of-year value of a portfolio that begins the year with in stocks and in bonds?

- Identify Values: Identify the values given for stocks and bonds at the beginning of the year.Stocks at the beginning of the year : Bonds at the beginning of the year : The expression to calculate the end-of-year value is .

- Substitute Given Values: Substitute the given values into the expression.End-of-year value =

- Perform Calculations: Perform the calculations for each part of the expression.Calculate the value from stocks: Calculate the value from bonds:

- Calculate Total Value: Add the calculated values to find the total end-of-year value of the portfolio.Total end-of-year value = (from stocks) + (from bonds) =

More problems from Interpret parts of quadratic expressions: word problems

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help