Full solution

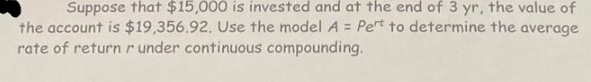

Q. Suppose that is invested and at the end of , the value of the account is . Use the model to determine the average rate of return under continuous compounding.

- Write Down Given Information: First, let's write down what we know:Initial investment = Final amount = Time = yearsWe need to find the rate .

- Use Continuous Compounding Formula: We use the formula for continuous compounding: . Let's plug in the values we know: .

- Solve for Rate: Now, we need to solve for . Let's start by dividing both sides by .

- Calculate Natural Logarithm: Calculate the left side: .So, .

- Apply Natural Logarithm Property: Next, we take the natural logarithm () of both sides to get rid of the exponential.

- Calculate Natural Logarithm: The natural logarithm of to the power of something is just that something, so:

- Divide to Solve for Rate: Calculate the natural logarithm of : . So, .

- Calculate Average Rate of Return: Now, divide both sides by to solve for .

- Calculate Average Rate of Return: Now, divide both sides by to solve for . Calculate : .So, , which is the average rate of return.

More problems from Compound interest

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help