AI tutor

Welcome to Bytelearn!

Let’s check out your problem:

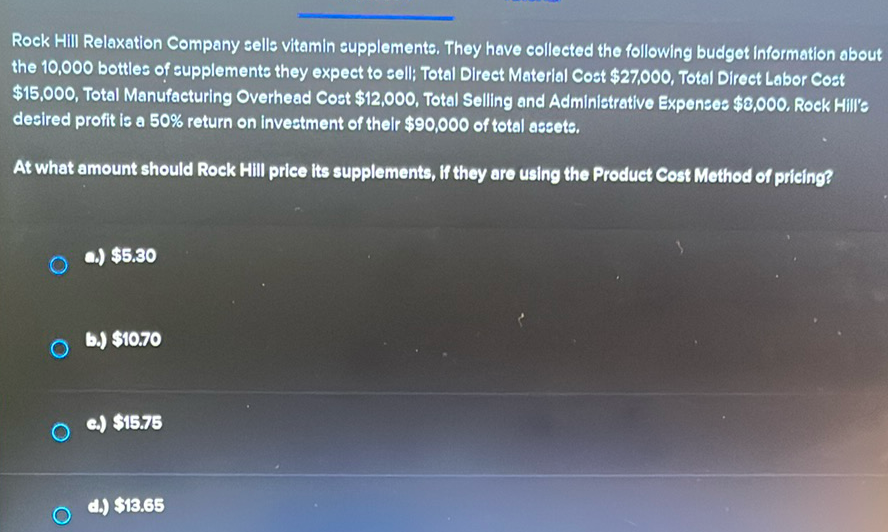

Rock Hill Relaxation Company sells vitamin supplements. They have collected the following budgot information about the , bottles of supplemente they expect to sell; Total Direct Material Cost , Total Direct Labor Cost , Total Manufacturing Overhead Cost , Total Selling and Administrative Expenees . Rock Hill's desired profit is a return on investment of their of total assets.At what amount should Rock Hill price its supplements, II they are using the Product Cost Method of prieing?a) b.) c) d)

Full solution

Q. Rock Hill Relaxation Company sells vitamin supplements. They have collected the following budgot information about the , bottles of supplemente they expect to sell; Total Direct Material Cost , Total Direct Labor Cost , Total Manufacturing Overhead Cost , Total Selling and Administrative Expenees . Rock Hill's desired profit is a return on investment of their of total assets.At what amount should Rock Hill price its supplements, II they are using the Product Cost Method of prieing?a) b.) c) d)

- Calculate Total Product Cost: Calculate the total product cost.Total product cost includes direct material cost, direct labor cost, and manufacturing overhead cost.Total Product Cost = Total Direct Material Cost + Total Direct Labor Cost + Total Manufacturing Overhead CostTotal Product Cost = + + Total Product Cost =

- Calculate Desired Profit: Calculate the desired profit.Rock Hill's desired profit is a % return on investment of their of total assets.Desired Profit = % of Total AssetsDesired Profit = Desired Profit =

- Calculate Total Cost: Calculate the total cost including desired profit.Total Cost = Total Product Cost + Desired ProfitTotal Cost = + Total Cost =

- Calculate Price per Bottle: Calculate the price per bottle.To find the price per bottle, divide the total cost by the number of bottles expected to be sold.Price per Bottle = Total Cost / Number of BottlesPrice per Bottle = bottlesPrice per Bottle =

- Add Expenses to Price: Add the selling and administrative expenses per bottle to the price.Total Selling and Administrative Expenses = Selling and Administrative Expenses per Bottle = Total Selling and Administrative Expenses / Number of BottlesSelling and Administrative Expenses per Bottle = bottlesSelling and Administrative Expenses per Bottle =

- Calculate Final Price: Calculate the final price per bottle using the Product Cost Method.Final Price per Bottle = Price per Bottle + Selling and Administrative Expenses per BottleFinal Price per Bottle = + Final Price per Bottle =

More problems from Solve quadratic equations: word problems

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help