AI tutor

Welcome to Bytelearn!

Let’s check out your problem:

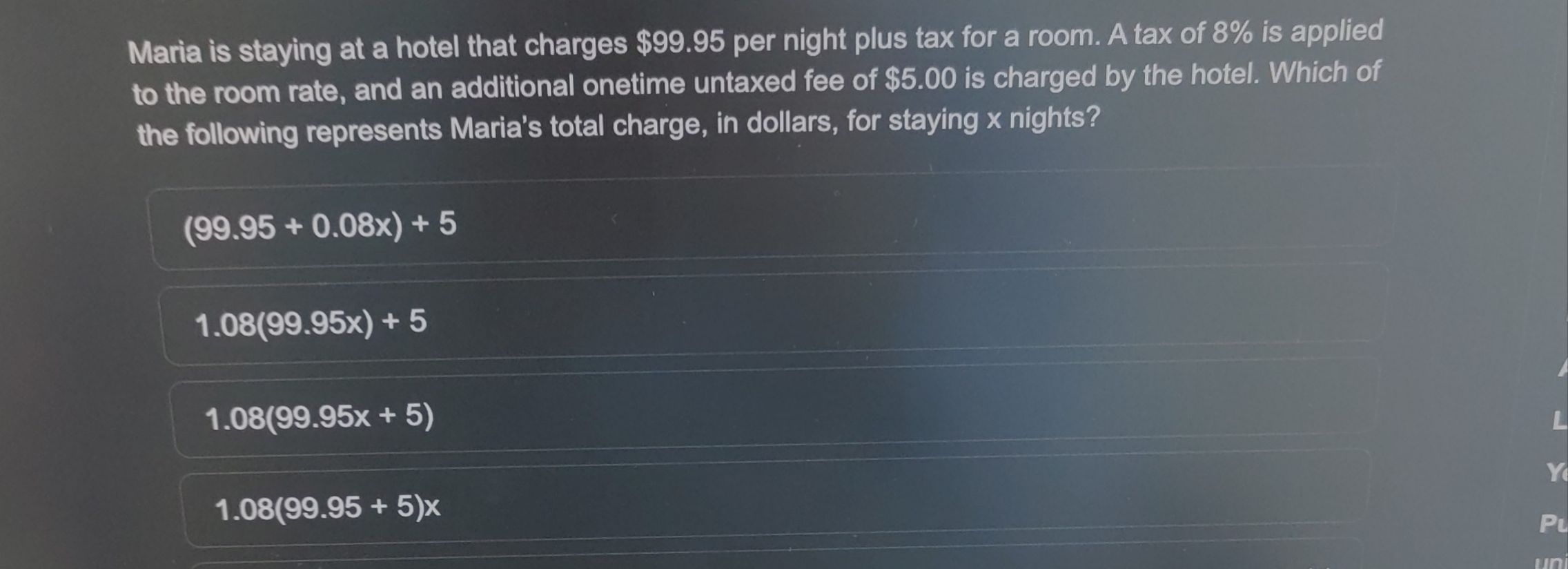

Maria is staying at a hotel that charges per night plus tax for a room. A tax of is applied to the room rate, and an additional onetime untaxed fee of is charged by the hotel. Which of the following represents Maria's total charge, in dollars, for staying nights?

Full solution

Q. Maria is staying at a hotel that charges per night plus tax for a room. A tax of is applied to the room rate, and an additional onetime untaxed fee of is charged by the hotel. Which of the following represents Maria's total charge, in dollars, for staying nights?

- Rephrase the Problem: First, let's rephrase the "What is Maria's total charge for staying nights at a hotel with a nightly rate of , an tax, and a one-time untaxed fee of ?"

- Calculate Room Cost: Calculate the total room cost for nights before tax. This is done by multiplying the nightly rate by the number of nights.Total room cost before tax =

- Calculate Tax: Calculate the tax on the total room cost. Since the tax rate is , we multiply the total room cost before tax by .Tax amount = Total room cost before tax Tax amount =

- Add Tax to Room Cost: Add the tax amount to the total room cost before tax to get the total room cost after tax.Total room cost after tax = Total room cost before tax + Tax amountTotal room cost after tax =

- Simplify Total Cost: Simplify the expression for the total room cost after tax by factoring out the common factor of .Total room cost after tax = Total room cost after tax =

- Add One-Time Fee: Add the one-time untaxed fee of to the total room cost after tax to get Maria's total charge.Maria's total charge = Total room cost after tax + One-time feeMaria's total charge =

- Examine Given Options: Now, let's examine the given options to see which one correctly represents Maria's total charge for staying nights.Option : This option is incorrect because it adds the tax rate to the nightly rate before multiplying by the number of nights, and it also incorrectly adds the one-time fee inside the parentheses.Option : This option correctly applies the tax to the total room cost before adding the one-time fee, which matches our calculation.Option : This option incorrectly applies the tax to the sum of the total room cost and the one-time fee, which is not taxed.Option : This option incorrectly applies the tax to the nightly rate plus the one-time fee before multiplying by the number of nights, which is not how the tax is calculated.The correct representation of Maria's total charge for staying nights is given by Option .

More problems from Multi-step problems with percents

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help