Full solution

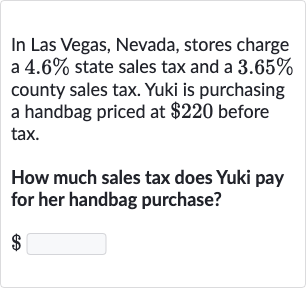

Q. In Las Vegas, Nevada, stores charge a state sales tax and a county sales tax. Yuki is purchasing a handbag priced at before tax.How much sales tax does Yuki pay for her handbag purchase?

- Calculate State Sales Tax: Calculate the state sales tax amount.State sales tax rate: Handbag price: State sales tax amount = Handbag price State sales tax rateState sales tax amount = State sales tax amount =

- Calculate County Sales Tax: Calculate the county sales tax amount.County sales tax rate: Handbag price: County sales tax amount = Handbag price County sales tax rateCounty sales tax amount = County sales tax amount =

- Calculate Total Sales Tax: Calculate the total sales tax amount.Total sales tax = State sales tax amount + County sales tax amountTotal sales tax = + Total sales tax =

More problems from Multi-step problems with percents

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help