Full solution

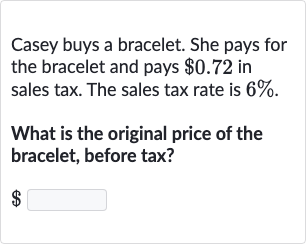

Q. Casey buys a bracelet. She pays for the bracelet and pays in sales tax. The sales tax rate is .What is the original price of the bracelet, before tax?

- Given Information: We have:Sales tax paid: Sales tax rate: To find the original price of the bracelet before tax, we need to calculate how much the sales tax is in relation to the original price. We can use the formula:Original price = Sales tax paid / Sales tax rateFirst, we need to convert the sales tax rate from a percentage to a decimal by dividing by .Sales tax rate in decimal =

- Convert to Decimal: Now we can calculate the original price using the sales tax paid and the sales tax rate in decimal form.Original price = Sales tax paid / Sales tax rate in decimalOriginal price = Original price =

More problems from Multi-step problems with percents

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help