Full solution

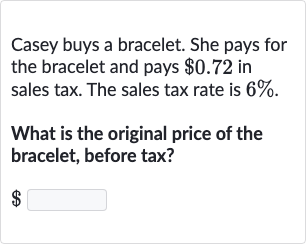

Q. Casey buys a bracelet. She pays for the bracelet and pays in sales tax. The sales tax rate is .What is the original price of the bracelet, before tax?_________

- Given Information: We know:Sales tax paid: Sales tax rate: (which is in decimal form)To find the original price before tax, we need to calculate how much the bracelet cost before the sales tax was added. We can use the formula:Sales tax paid = Original price Sales tax rateLet's rearrange the formula to solve for the original price:Original price = Sales tax paid / Sales tax rateNow we can plug in the values we know:Original price =

- Formula for Original Price: Let's do the calculation:Original price =

- Calculation: We should check our math to ensure there are no errors. If we multiply the original price by the sales tax rate, we should get the sales tax paid:This confirms our calculation is correct.

More problems from Multi-step problems with percents

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help