AI tutor

Welcome to Bytelearn!

Let’s check out your problem:

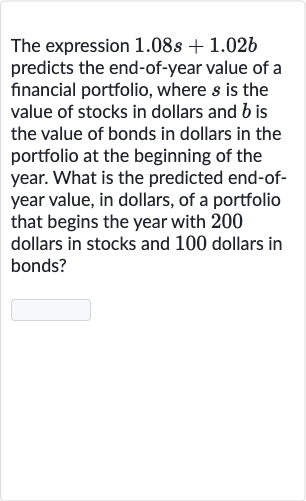

The expression predicts the end-of-year value of a financial portfolio, where is the value of stocks in dollars and is the value of bonds in dollars in the portfolio at the beginning of the year. What is the predicted end-of year value, in dollars, of a portfolio that begins the year with dollars in stocks and dollars in bonds?

Full solution

Q. The expression predicts the end-of-year value of a financial portfolio, where is the value of stocks in dollars and is the value of bonds in dollars in the portfolio at the beginning of the year. What is the predicted end-of year value, in dollars, of a portfolio that begins the year with dollars in stocks and dollars in bonds?

- Identify Values: Identify the values given in the problem.We are given the initial value of stocks as and the initial value of bonds as . The expression to calculate the end-of-year value of the portfolio is .

- Substitute Given Values: Substitute the given values into the expression.We need to substitute and into the expression to find the end-of-year value of the portfolio.

- Perform Calculations: Perform the calculations.Now we calculate the expression with the substituted values:= = The predicted end-of-year value of the portfolio is dollars.

More problems from Interpret parts of quadratic expressions: word problems

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help

QuestionGet tutor help